In an attempt to join PTB's Blog Carnival for June, I came up with the 3P's.

1. Prioritize

“Decide what you want, decide what you are willing to exchange for it. Establish your priorities and go to work.” -- H.L. Hunt

Deciding that you really want something means pushing that thing on top of your priority list. As for me, I have long decided that this "thing" is being outside and experiencing places. Three years ago, when I was still unsure, shoes, clothes, bags, and weekend dine-outs were a regular part of my monthly budget. When it finally dawned on me that I was happier when I put my money where my heart is, I have removed these from my list and only bought things on a per need basis.

It also helped that I stumbled on minimalism blogs a couple of years ago and these inspired me to stop acquiring piles in my life. Minimalism is getting rid of the inessential to focus on what really matters, both in possessions and relationships. I have long wanted to fully embrace minimalism and though I have not yet started cleaning up my clutter, I have started to apply this on buying things. When I get new things now, I make sure that I only buy what I need. It is not an easy task, I sometimes still find myself struggling in refusing these pretty things that I deem unnecessary. When I am depressed, no amount of retail therapy can cheer me up, except if retail involves a drink or booking a ticket to somewhere.

This is not to say that I am no longer enticed with other things. In fact right now, I think I need to buy a new phone because I really, really need GoogleMaps and maybe a new compact camera too!

I'm convinced that the first step in funding your wanderlust is to decide that it is what you really want. When it becomes a top priority, you will lose all your interest in other things that might take your focus off from the goal.

2. Plan

“Action expresses priorities.” -- Mahatma Gandhi

You don't need to tell people what your priorities are. Actions are screaming proof of what those are. Planning does not mean mapping out the itinerary, much of the fun comes from spontaneity. By planning, I mean scheduling the trips well.

You don't need to tell people what your priorities are. Actions are screaming proof of what those are. Planning does not mean mapping out the itinerary, much of the fun comes from spontaneity. By planning, I mean scheduling the trips well. Prior to a trip, I estimate my expenses and do a budget calculation. This is of course done by researching for what will be my itinerary and allotting some extra for miscellaneous spending. This way I get to know how much money I need to save up. I am guilty of not having a travel fund and that means I need to pool cash at least a month before a trip. Setting money aside for a travel fund will allow you to go for those sudden, unscheduled trips. I have been contemplating on starting a travel fund within the year for my dreams of visiting other continents.

3. Put Into Action

“A budget tells us what we can't afford, but it doesn't keep us from buying it.” -- William Feather

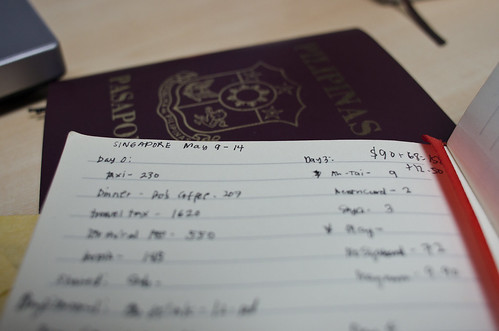

And the last thing to complete this is to actually stick to the budget. Sometimes I tend to overspend around a few thousands on sudden activities and pasalubongs. I keep a notebook handy where each night I jot down all of my expenses for the day. At first I found it tedious since at the end of the day I would usually just want to lay down and sleep, but when I started doing this, it became a habit. It's a good way of tracking down expenses and see if you are sticking with your budget. This has also helped me in recommending activities to friends. It also serves as a of journal for the things you did for the day, including the price that came with it. If you have done your research, you will most likely know the places where you will get the quality that you paid for. Not spending beyond your budget means that you can save some extra money for the next trip.